MGT201 Solved MCQs and Past Papers

Dear Students, Here you can read online or Download MGT201 - Financial Management Solved MCQs , Past Papers Mega Collection for Preparation of Mid Term Exams. PDF file includes 1140 Pages of Solved MCQs and Past Papers for Mid term. You can also Download MGT201 Formulas from chapter 1 to 22 for Mid Term as a Gift for You. we have added a Sample Preview of your required file below with download Link. |

| MGT201 Solved MCQs and Past Papers - Formulas Mega Collection for Mid term |

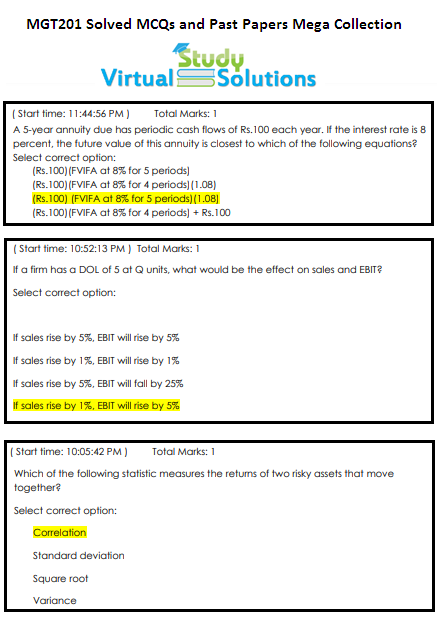

MGT201 Solved MCQs and Past Papers Sample Preview

You can see the Sample Preview of MGT201 Solved MCQs and Past Papers Mega Collection provided by (Virtual Study Solutions) below. Sample Page Preview has been added below in pdf format. Click on Download Button to Download Solution File in Your PC. Please Share it with your friends. You can also like our Facebook Page or Subscribe Us below for Updates.

|

| MGT201 Solved MCQs and Past Papers Mega Collection PDF File Sample Preview |

MGT201 Formula Collection for Mid Term Sample Preview

We have also Added MGT201 Formulas from chapter 1 to 22 for Mid Term as a Gift for You. Download Link is also Given of MGT201 Formulas in PDF Format.

|

| MGT201 Formulas from chapter 1 to 22 for Mid Term Sample Preview |

MGT201 Formula Collection for Mid Term Demo

Assets +Expense = Liabilities + Shareholders’ Equity + Revenue

Liabilities = Equity = Net Worth Revenue – Expense = Income

1. Statement of Retained Earnings or Shareholders’ Equity Statement

Total Equity = Common Par Stock Issued + Paid In Capital + Retained Earnings

2. Current Ratio:

= Current Assets / Current Liabilities

3. Quick/Acid Test ratio:

= (Current Assets – Inventory) / Current Liabilities

4. Average Collection Period:

= Average Accounts Receivable /(Annual Sales/360)

5. PROFITABILITY RATIOS: Profit Margin (on sales):

= [Net Income / Sales] X 100

Return on Assets:

= [Net Income / Total Assets] X 100

Return on equity:

= [Net Income/Common Equity]

6. ASSET MANAGEMENT RATIOS Inventory Turnover:

= Sales / inventories

Total Assets Turnover: = Sales / Total Assets

7. DEBT (OR CAPITAL STRUCTURE) RATIOS:

Debt-Assets:

= Total Debt / Total Assets

Debt-Equity:

= Total Debt / Total Equity

Times-Interest-Earned:

= EBIT / Interest Charges

8. Market Value Ratios:

Price Earning Ratio:

= Market Price per share / *Earnings per share

Market /Book Ratio:

= Market Price per share / Book Value per share

*Earning Per Share (EPS):

= Net Income / Average Number of Common Shares Outstanding

9. M.V.A (Market Value Added):

MVA (Rupees) = Market Value of Equity – Book Value of Equity Capital

10. E.V.A (Economic Value Added):

EVA (Rupees) = EBIT (or Operating Profit) – Cost of Total Capital

mojy mgt 211 ky sloved mcqs chahy jo ky grand quiz ma kam ay phaly b apky bahot achy thy mcqs

ReplyDelete