MGT201 Assignment No 1 Spring 2019

Dear Students, Here you can read or Download MGT201 - Financial Management Assignment No 1 Solution of Spring 2019. MGT201 Assignment Due Date is 22 July 2019. Total Marks are 20. We are here to facilitate your learning and we do not appreciate the idea of copying or replicating solutions. MGT201 Assignment Solution File has been added. Previously we shared MTH401 Assignment No 2 Solution Spring 2019. |

| MGT201 Assignment No 1 Solution and discussion Spring 2019 |

MGT201 Assignment FORMATTING GUIDELINES:

- • Use the font style “Times New Roman” or “Arial” and font size “12”

- • It is advised to compose your document in MS-Word format

- • You may also compose your assignment in Open Office format

- • Use black and blue font colors only RULES FOR MARKING

Please note that your assignment will not be graded or graded as Zero (0), if:

- It is submitted after the due date.

- The file you uploaded does not open or is corrupt.

- It is in any format other than MS-Word or Open Office; e.g. Excel, PowerPoint, PDF etc.

- Not submitted as per given format

- It is cheated or copied from other students, the internet, books, journals, etc.

MGT201 Assignment Question:

Stock and Bond valuationStocks and bonds are two major categories of investment available for investors. Both have distinct features and are selected by the investors with different risk taking behaviors. Stocks being riskier than bonds are selected by the investors with a desire to earn more while bonds are the preference of investors who like to earn secure returns with low risk appetite. The combination of these two can provide a balanced return to investors who wish to have a portfolio that can generate optimal returns. The selection of bonds and stocks is dependent on the market as well as company specific factors and evaluation of both factors leads towards a good investment decision. Such information is vital for investment purpose for any investor.

Required:

An investor, Mr. Ahmed is planning to add shares and bonds in his investment portfolio for which two options are available in the market with the following information:

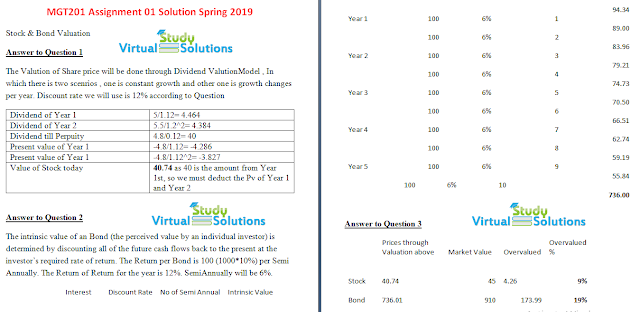

1. Shares of Z&R Corporation are currently selling at price of Rs. 45 per share. The forecasted dividend for 1st year is Rs. 5 per share while for year 2 it will be Rs. 5.5 per share. The price of share after year 2 is expected to be Rs. 50. Currently company is paying a dividend of Rs. 4.8 per share while rate of return for such type of investment is 12% per annum. 2. Raheem Corporation has recently issued a 5 years bond with par value of Rs. 1000 for a 10% semiannual coupon payment. The market interest rate for such type of investments is 12% per annum. Bond is currently trading at Rs. 910.

You are required to help Mr. Ahmed in valuation of both investment options by calculating:

- Value of stock today (8 marks)

- The intrinsic value of the bond (8 marks)

- Compare stock and bond prices with their market prices and identify whether stock and bond is overvalued or undervalued? Justify your answer with proper calculation and reasoning (4 Marks).

MGT201 Assignment No 1 Solution Spring 2019

You can see the Sample Preview of MGT201 Assignment No 1 Solution provided by (Virtual Study Solutions) below. Click on Download Button to Download Solution File in Your PC. Please Share it with your friends. You can also like our Facebook Page or Subscribe Us below for Updates.Spring 2019 Assignments:

Is the solution provided is correct or not

ردحذف